The long-awaited Ethereum (ETH) update, dubbed “the merge,” has arrived. Google Search commemorated the “Ethereum merge” by depicting two bears, one white for the consensus layer and the other brownish black, combining to form the ultimate Ethereum panda bear, a metaphor for post-merge Ethereum.

The merge converts the Ethereum network from an energy-intensive proof-of-work consensus mechanism to a proof-of-stake consensus mechanism.

What is the Merge?

The merge, previously known as Ethereum 2.0, is an upgraded version of the Ethereum blockchain that uses a proof-of-stake consensus mechanism to verify transactions through staking.

The mechanism for staking Ethereum is designed to replace the proof-of-work model, in which cryptocurrency miners use high-powered computers to perform complex mathematical functions known as hashes. To verify Ethereum transactions before they are recorded on the public blockchain, the mining process consumes an increasing amount of electricity.

Proof-of-work systems consume enormous amounts of electricity. Bitcoin mining, for example, currently consumes 127 terawatt-hours of electricity per year (TWh). That is now more than the entire country of Norway’s power consumption.

With proof of work, Ethereum had an annual power consumption comparable to Finland and a carbon footprint comparable to Switzerland. Following the merger, Ethereum is expected to reduce its carbon footprint by up to 99.95%, addressing one of the cryptocurrency’s major criticisms.

What is the difference between Ethereum and Ethereum 2.0?

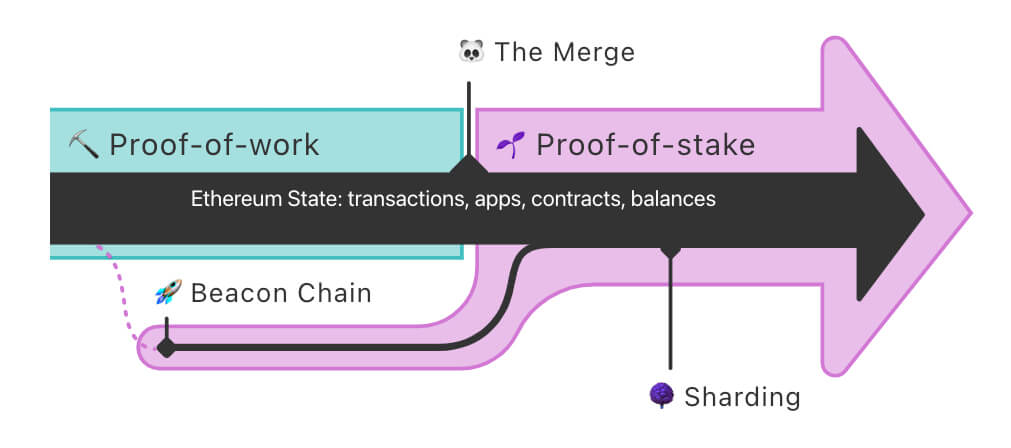

In December 2020, Ethereum launched two parallel blockchains: a legacy one that uses proof of work (Ethereum Mainnet) and a new chain that uses proof of stake (Beacon Chain). The merger combined Ethereum’s Mainnet and Beacon Chain into a single blockchain that uses a proof of stake protocol. Since its inception in 2020, the Beacon Chain has served as a proof-of-stake ledger on the Mainnet. ETH1 and ETH2 were the original names for the Ethereum Mainnet and Beacon Chain, respectively. Their eventual merger was to be known as Ethereum 2.0.

However, in January, the Ethereum Foundation requested that the term “Ethereum 2.0” be phased out. The Foundation determined that language was no longer an accurate representation of their roadmap. They thought Ethereum 2.0 sounded too much like a different operating system, which is not what the merger is meant to accomplish.

Because Ethereum 2.0 is no longer in use, the Ethereum Foundation has asked users to refer to the Ethereum Mainnet as the “execution layer,” rather than ETH1, and the Beacon Chain as the “consensus layer,” rather than ETH2. This terminology, they believe, better reflects their platform goals. Many cryptocurrency investors and enthusiasts, however, continue to refer to post-merge Ethereum as Ethereum 2.0.

Ethereum is transitioning from mining to staking

With the completion of the Ethereum merger, the staking process will replace the mining process for transaction verification. To participate in the transaction verification process, users must stake a certain amount of cryptocurrency. An algorithm determines which validator gets to add the next block to a blockchain in a proof-of-stake model based on how much cryptocurrency the validator has staked.

To become an Ethereum validator, investors must stake at least 32 ETH. Currently, there are over 300,000 Ethereum validators. The more ETH a validator stakes, the more likely it is to generate blocks. Each time a validator creates a block, the validator earns Ethereum rewards for handling validation duties. With the price of Ethereum approaching $1,600, the minimum requirement of 32 ETH is more than $50,000; staking can be quite costly for the average investor.

Individual investors, on the other hand, can join staking pools, which are groups of Ethereum stakers who pool their resources and split the rewards. Most major cryptocurrency exchanges also offer staking services to investors who are unable or unwilling to commit 32 ETH on their own.

Ethereum’s staking yield currently ranges between 4% and 7% per year (APR). Staked ETH (stETH) has been locked up in the run-up to the merge. However, experts claim that the ability to withdraw stETH is not instantaneous.

Ethereum vs. Bitcoin

Bitcoin and Ethereum are the most popular cryptocurrencies, accounting for roughly 60% of the global cryptocurrency market capitalization. In the last five years, the price of Ethereum has increased 453%. This is more than Bitcoin, which has increased by more than 431% during the same time period.

From an environmental, social, and corporate governance (ESG) standpoint, the merger makes Ethereum a more appealing investment than Bitcoin, but it does not necessarily make Ethereum a threat to dethrone Bitcoin as the world’s top crypto.

According to Chris Kline, co-founder and chief operating officer of Bitcoin IRA, Bitcoin and Ethereum are more complementary than competitive in the crypto market.

[…] will be no more Ethereum mining after the merger (ETH). The leading altcoin has abandoned its proof-of-work consensus mechanism in favor of […]